Lukka’s institutional-quality data management software is built within an AICPA SOC 1 Type II and SOC 2 Type II infrastructure and provides a comprehensive, secure, and scalable technology for your crypto middle and back-office.

Home › Lukka Reference Data

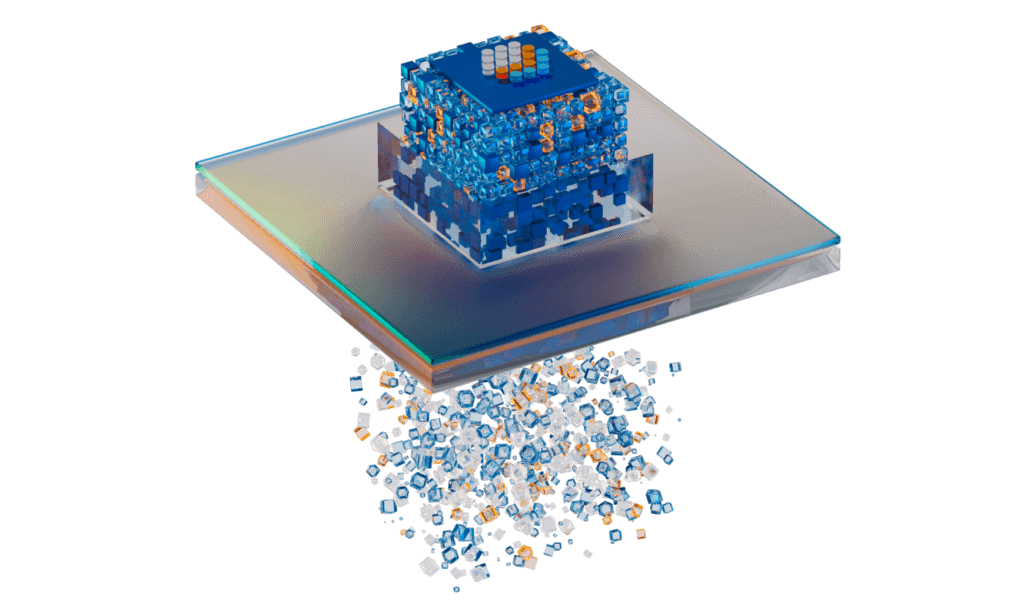

Empower Your Crypto Asset Management with Lukka Reference Data

…and hundreds more businesses.

Elevate your understanding and management of digital assets with Lukka’s comprehensive suite of Reference Data services. From specialized Terms and Conditions data to intricate Mapping and Standardization, Lukka provides tools like the Crypto Actions Data for in-depth action insights, and the Crypto Asset Score for potential assessment. Dive into the digital asset ecosystem with Lukka’s definitive Classification Standards, Trading Venue Score for venue assessment, and Marketplace & Custodian Data for tailored marketplace and custodian insights. Plus, align your investments with your values using Lukka’s innovative Crypto Sustainability Score.

Streamline your digital asset management with Lukka’s specialized Terms and Conditions data service.

Navigate the complex world of digital assets with Lukka’s definitive classification standards.

Unlock the full potential of crypto actions data with Lukka’s comprehensive and detailed insights.

Mastering the intricacies of digital asset data for both marketplaces and custodians with Lukka’s specialized service.

Assess the potential of digital assets with confidence using Lukka’s advanced Crypto Asset Scoring system.

A single, easy to understand venue score derived from a complex and multi-dimensional ecosystem.

Navigate the crypto world with ease through Lukka’s comprehensive mapping and standardization data services.

Navigate the crypto space with an environmental, social, and governance perspective using Crypto Sustainability Score.

Speak with one of our data experts and unlock the full potential of your crypto business.